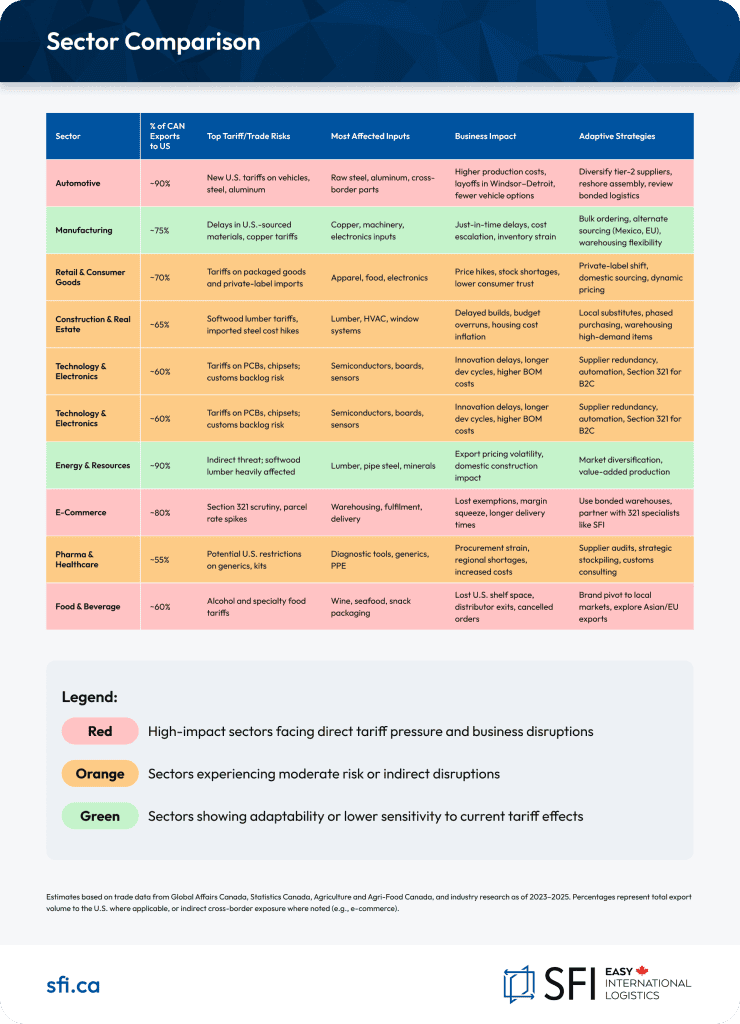

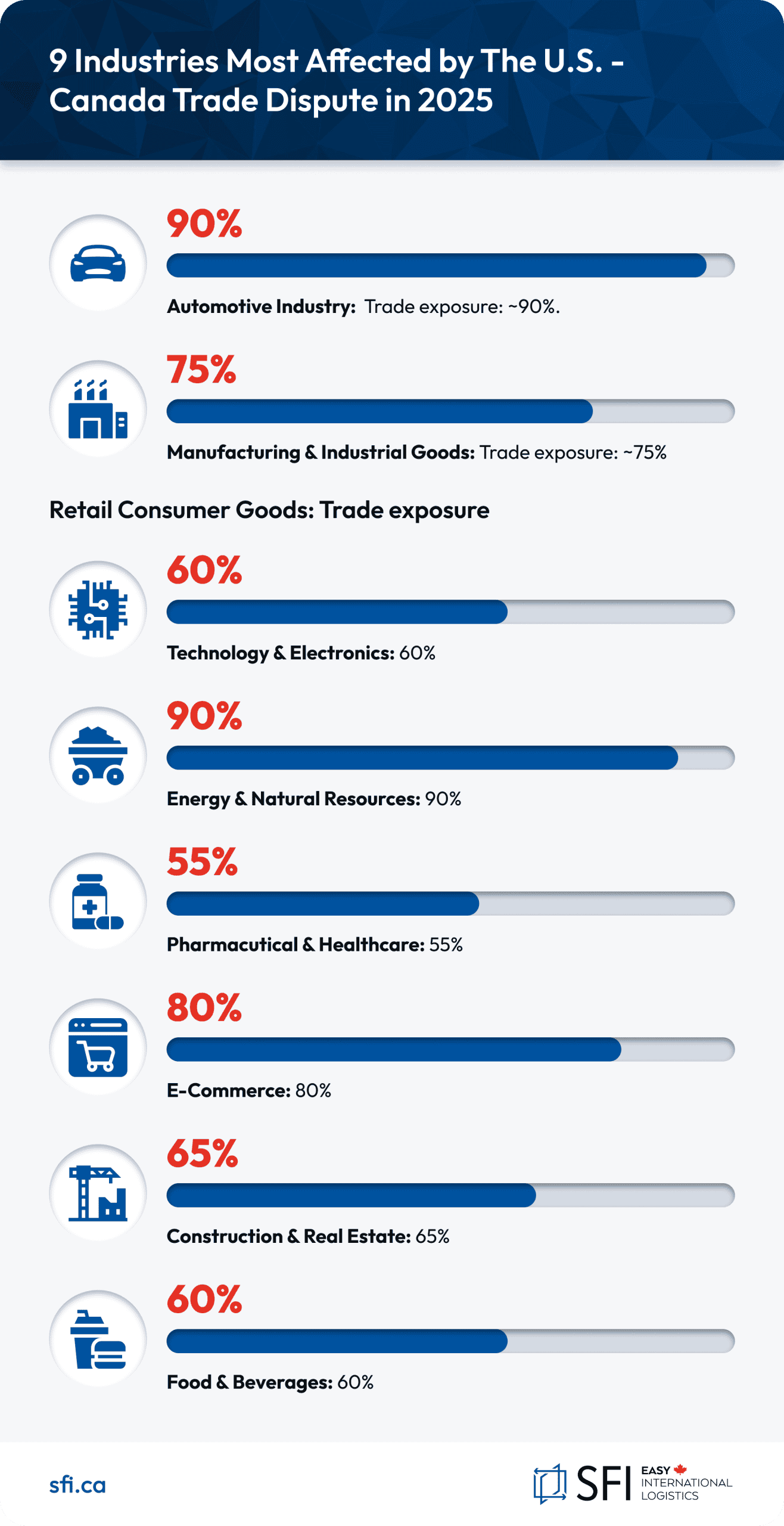

9 Industries Most Affected by the U.S.-Canada Trade Dispute in 2025

As of 2025, the once-stable trading relationship between Canada and the United States is being tested by a new wave of tariffs, countermeasures, and political recalibration. Triggered initially by U.S. tariffs on Canadian goods like aluminum, dairy, and softwood lumber, Canada’s April 2025 response, new duties on U.S. auto imports, marked a significant escalation in the economic standoff.

The economic stakes are high, and, according to RBC Thought Leadership, as much as $125 billion in Canadian economic activity is tied to sectors exposed to trade disruptions. These ripple effects are being felt not only in boardrooms and policy meetings, but also in auto assembly plants, farmland, fulfilment centres, and hospitals. Dennis Darby, CEO of Canadian Manufacturers & Exporters, aptly described the moment as “a critical inflection point for Canadian industry”. Let’s explore how this inflection is playing out across nine of Canada’s most exposed sectors.

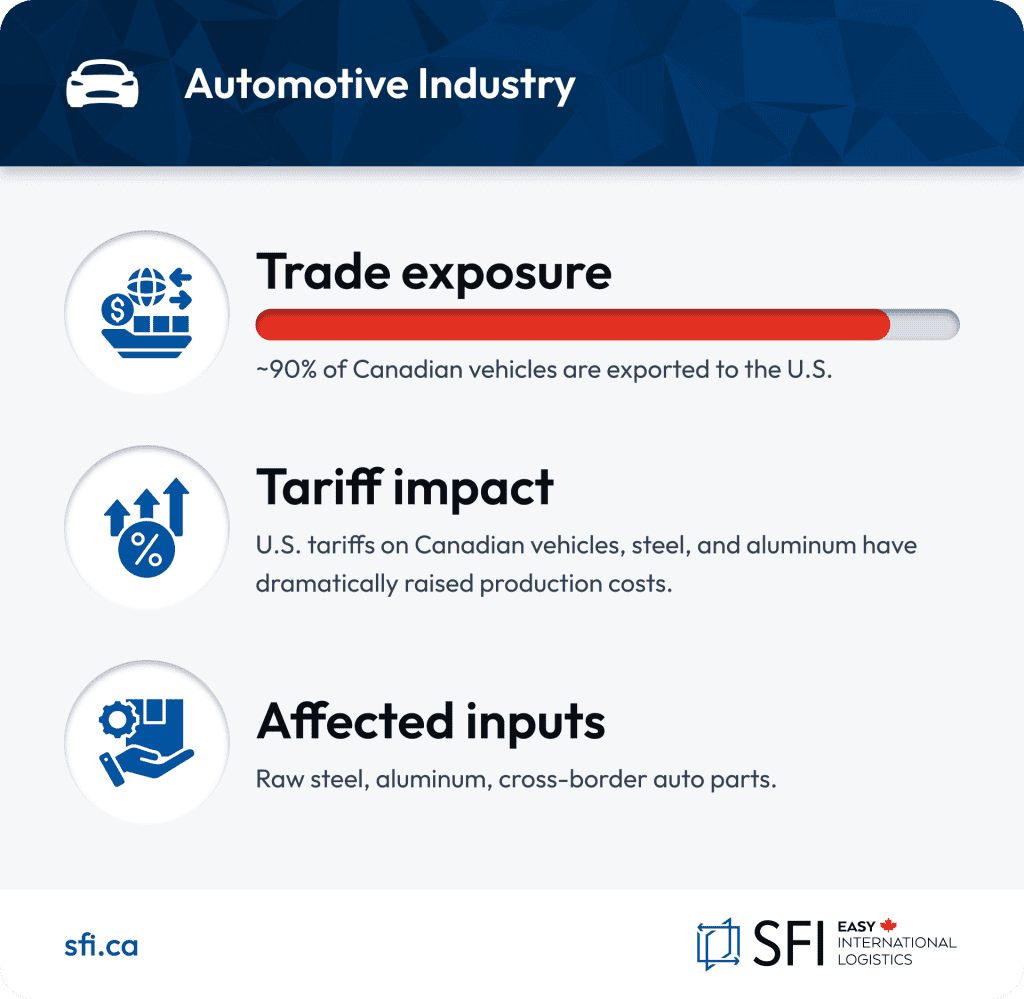

1. Automotive Industry

- Trade exposure: ~90% of Canadian vehicles are exported to the U.S.

- Tariff impact: U.S. tariffs on Canadian vehicles, steel, and aluminum have dramatically raised production costs.

- Affected inputs: Raw steel, aluminum, cross-border auto parts.

The Canada–U.S. auto manufacturing ecosystem is one of the most integrated in the world. Vehicles assembled in Ontario routinely cross the border several times before final delivery. This model, born of the 1965 Auto Pact and reshaped by both NAFTA and CUSMA, is now under pressure from dual-sided tariffs and policy unpredictability.

Electric vehicle manufacturer Lion Electric, which operates in Quebec and the U.S., is facing procurement delays and cost volatility that threaten its expansion strategy. In the Windsor-Detroit corridor, auto parts shortages have led some suppliers to consider temporary layoffs.

Unifor, Canada’s largest private sector union, has backed Canada’s counter-tariffs, framing them as a necessary defence:

“We support the federal government’s move to stand up for Canadian auto workers by imposing these tariffs. Our members deserve a level playing field,” the union stated in a recent release.

Across the board, the automotive industry is being pushed to reconfigure logistics, reevaluate supplier networks, and manage rising input costs, all while preparing for further volatility at the border.

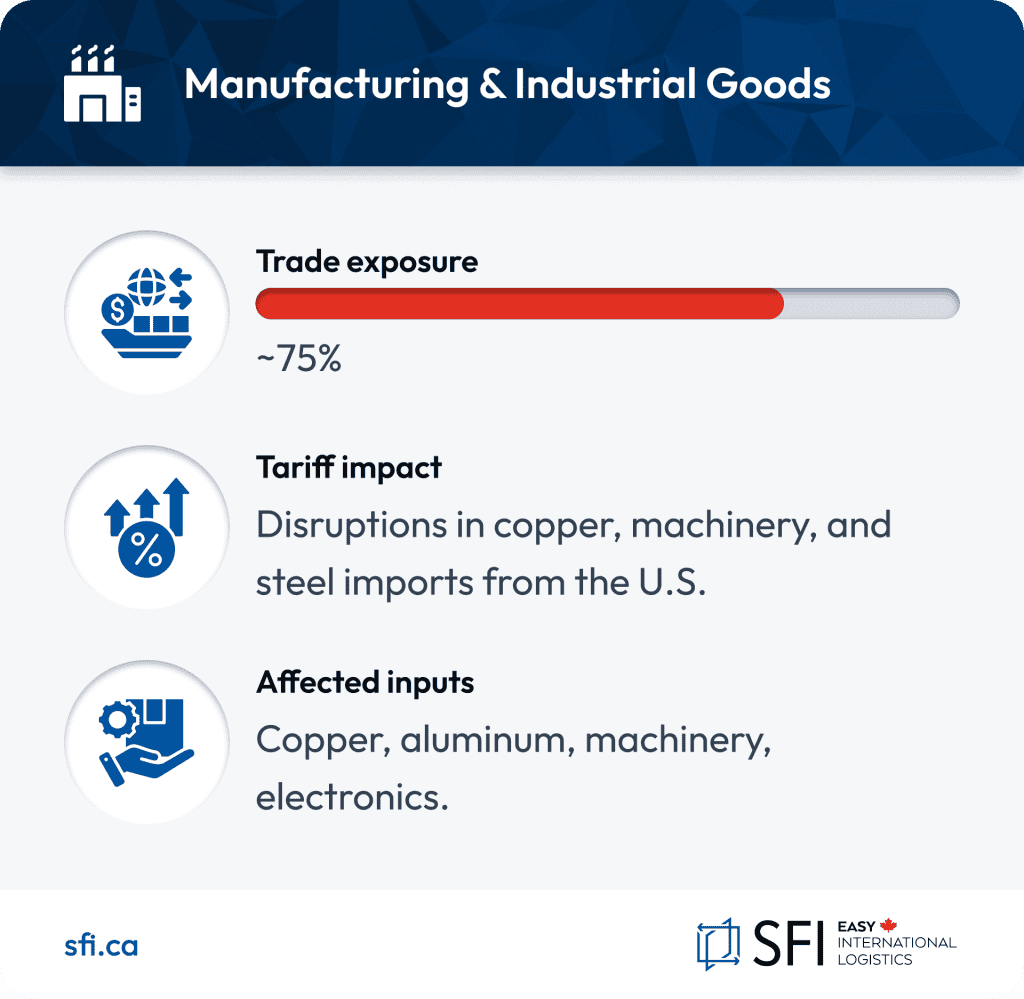

2. Manufacturing & Industrial Goods

- Trade exposure: ~75%

- Tariff impact: Disruptions in copper, machinery, and steel imports from the U.S.

- Affected inputs: Copper, aluminum, machinery, electronics.

From fabrication shops to major OEMs, Canadian manufacturers are navigating a cascade of cost escalations and logistical bottlenecks. The sector’s just-in-time model is now under pressure from border delays and vendor renegotiations.

According to Yahoo Finance, Canada’s Manufacturing Purchasing Managers’ Index (PMI) dropped to a 15-month low in April 2025, with many firms citing tariff uncertainty as the cause. Smaller manufacturers are especially vulnerable due to limited flexibility and cash reserves.

Many are also shifting import strategies to avoid goods being tariffed at the “sold” value when transferred from Canada to the U.S. Instead, importing directly into the U.S. from overseas at the factory cost helps reduce tariff exposure.

Industry response strategies include bulk ordering, exploring non-U.S. suppliers, and increasing domestic warehousing to hedge against volatility.

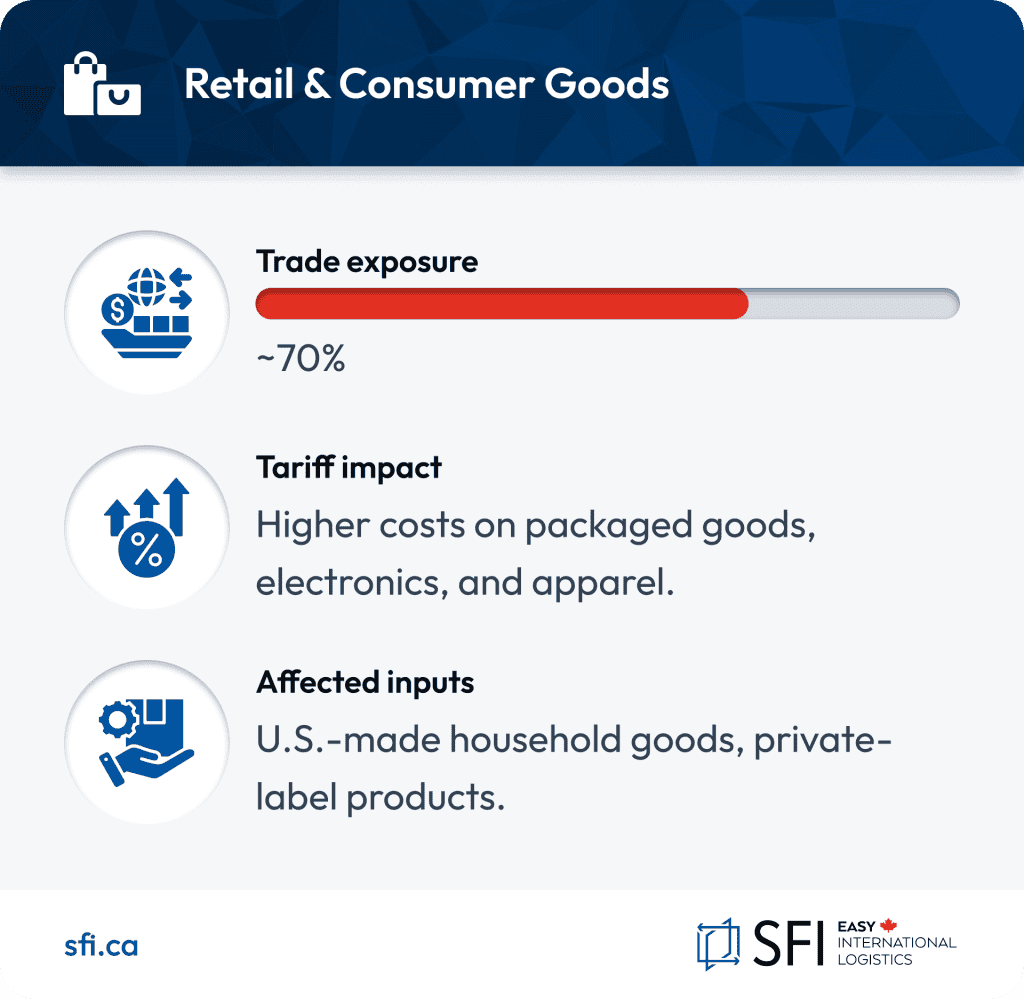

3. Retail & Consumer Goods

- Trade exposure: ~70%

- Tariff impact: Higher costs on packaged goods, electronics, and apparel.

- Affected inputs: U.S.-made household goods, private-label products.

Retailers are caught in the downstream impact of costlier imports and shipping delays. According to Retail Insider, even large retailers like Walmart and Costco are dealing with pricing volatility and longer lead times.

For smaller Canadian retailers, the pinch is even more pronounced. Without the buying power to negotiate, many are passing costs onto consumers. This is prompting changes in buying behaviour—shoppers are increasingly turning to Canadian-made or private-label alternatives.

Furthermore, Canadian retailers serving U.S. customers are increasingly opening U.S. warehouses to mitigate cross-border friction. By staging inventory in the U.S., they avoid the elevated tariffs that apply when goods cross the border at the Canadian sale price. As The Globe and Mail reports, this pivot echoes a broader trend among global retailers seeking to limit tariff exposure and protect profit margins.

Meanwhile, Global News highlights that rising costs are already pushing Canadian retailers to raise prices, with some warning of ongoing volatility tied to U.S. policy shifts.

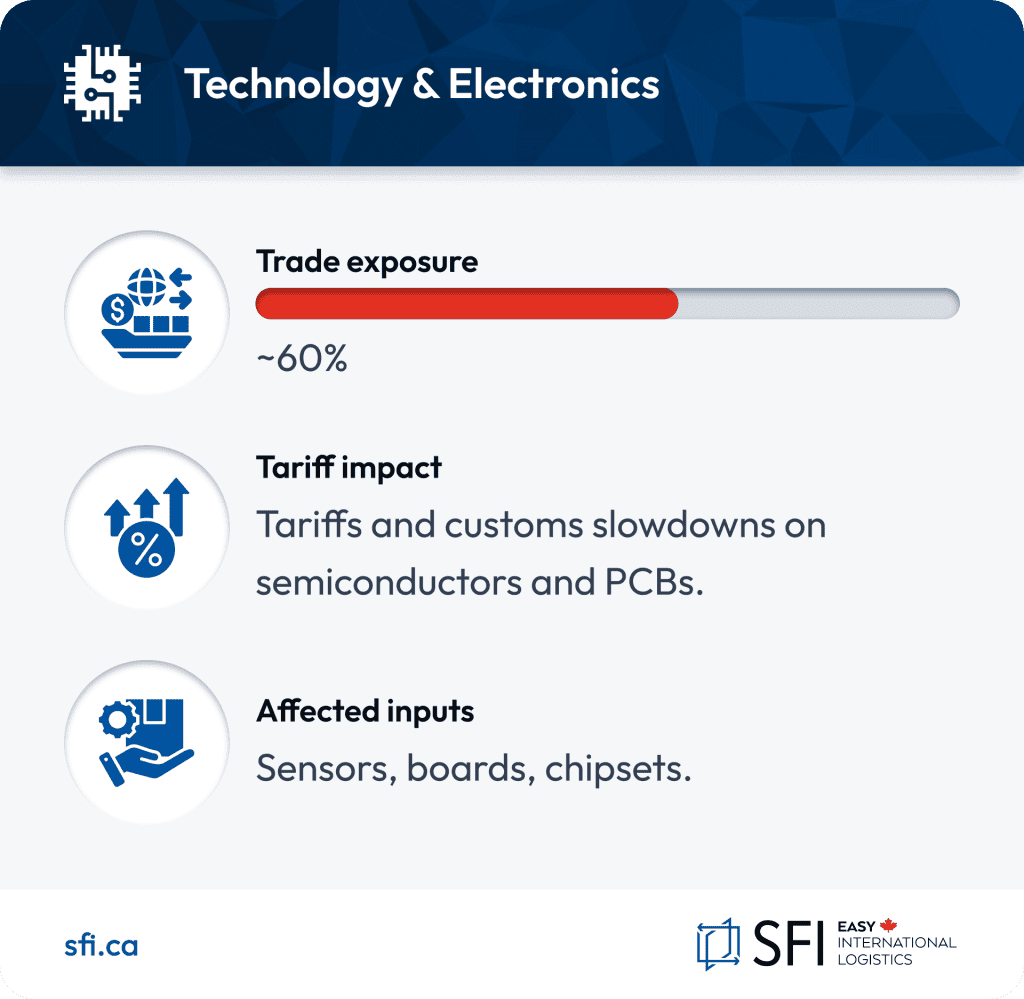

4. Technology & Electronics

- Trade exposure: ~60%

- Tariff impact: Tariffs and customs slowdowns on semiconductors and PCBs.

- Affected inputs: Sensors, boards, chipsets.

Canadian tech companies are navigating a quieter, but equally disruptive, trade war. The 2025 U.S. tariff package included select electronics categories, leading to uncertainty around pricing, sourcing, and development timelines.

According to the March 2025 global survey from the Global Electronics Association (formerly IPC), 31% of electronics manufacturers have invested in automation or process optimization to counter tariff-related pressures, and 28% have already shifted to non-tariffed suppliers. Another 61% are considering renegotiating supplier contracts, highlighting the urgency with which electronics firms are retooling their procurement strategies.

Startups in clean tech, IoT, and medical devices are especially exposed, with rising bill of materials (BOM) costs and extended lead times now impacting go-to-market plans. Some firms are exploring Section 321 strategies for consumer shipments and diversifying outside of North America entirely.

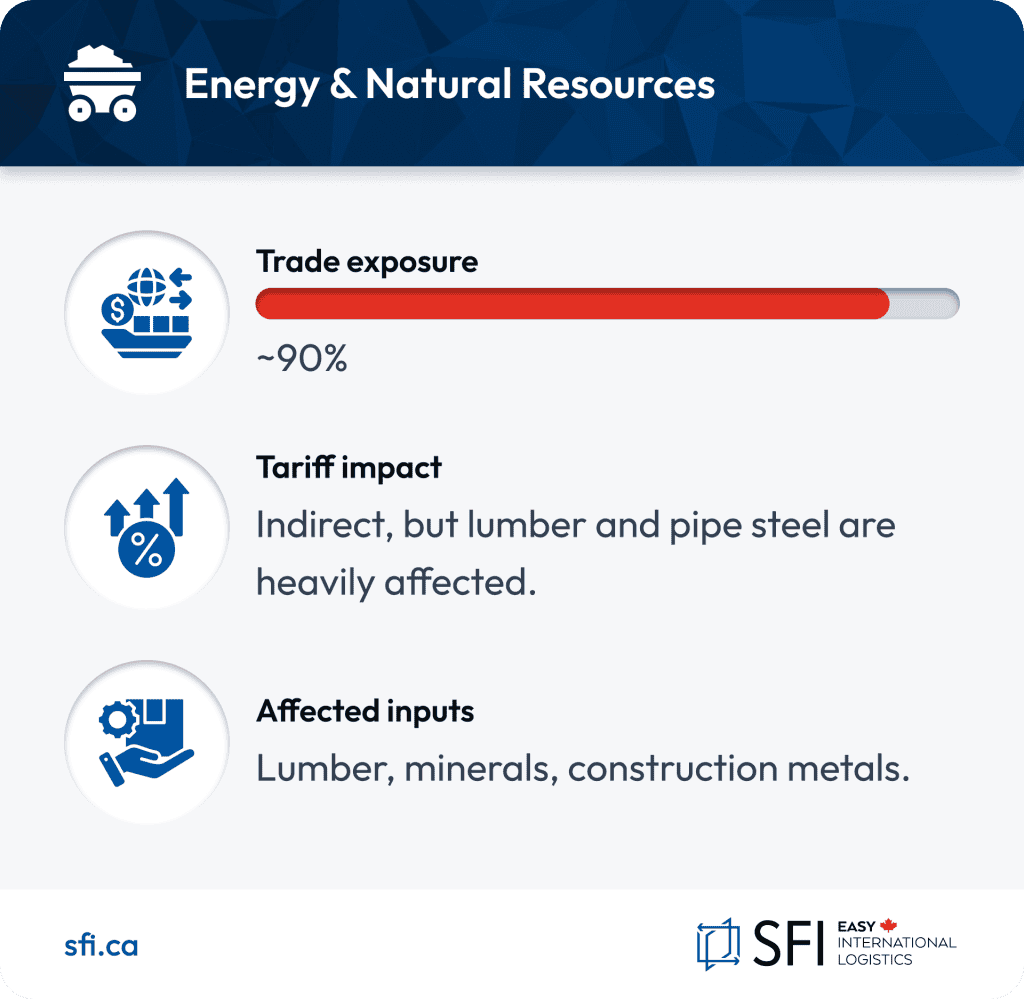

5. Energy & Natural Resources

- Trade exposure: ~90%

- Tariff impact: Indirect, but lumber and pipe steel are heavily affected.

- Affected inputs: Lumber, minerals, construction metals.

Oil and gas exports to the U.S. continue to flow, but the softwood lumber dispute has intensified, raising concerns across the entire energy and construction ecosystem.

According to the Canada Energy Regulator, over 90% of Canadian crude oil is exported to the U.S., yet producers are warily watching the escalation of retaliatory policy. In construction, higher lumber costs are feeding into housing inflation and infrastructure delays.

Industry resilience is strong, with many firms pursuing value-added processing and market diversification into Asia and Europe.

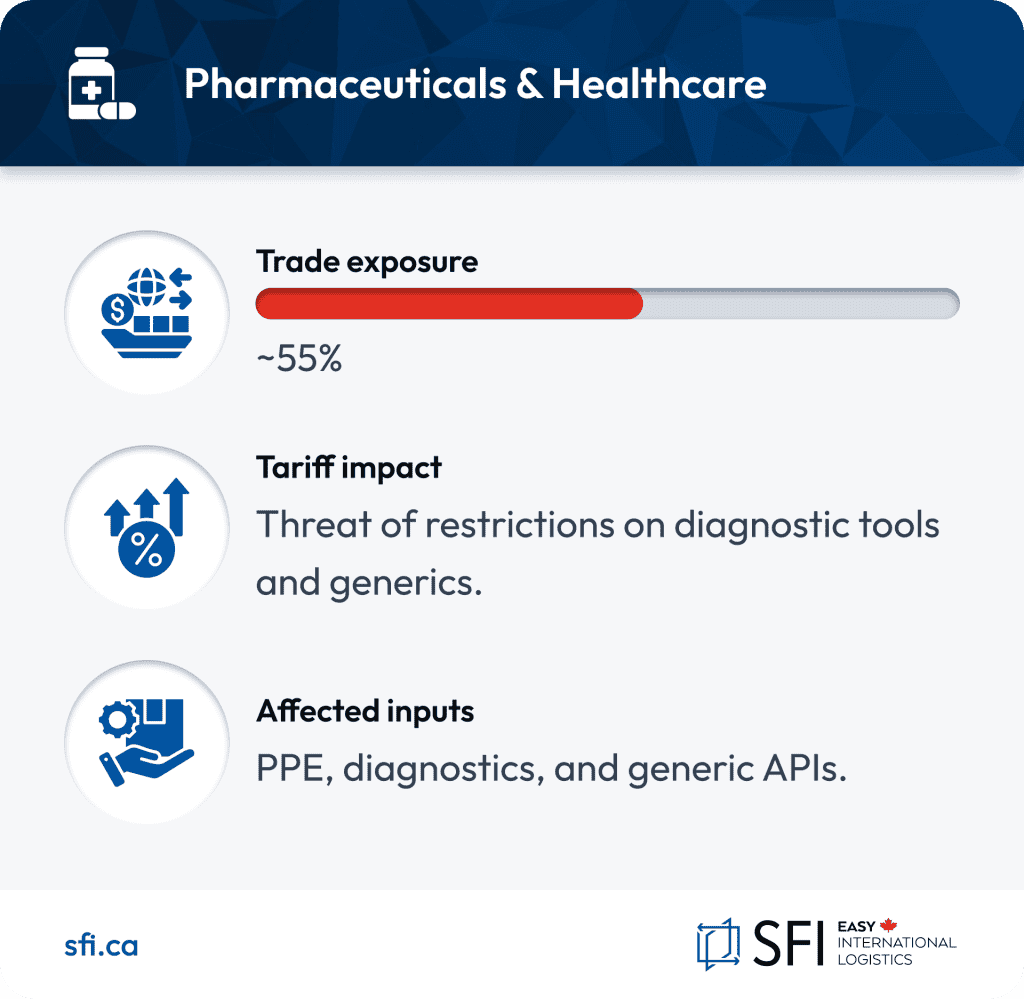

6. Pharmaceuticals & Healthcare

- Trade exposure: ~55%

- Tariff impact: Threat of restrictions on diagnostic tools and generics.

- Affected inputs: PPE, diagnostics, and generic APIs.

Healthcare may not make headlines in a tariff dispute, but even minor disruptions here have massive consequences. The U.S. has hinted at using pharmaceutical exports as leverage, potentially targeting low-cost generics and critical components.

Rural and regional hospitals are already facing delays in diagnostic tools and lab materials. While no widespread shortages have occurred, risk mitigation stockpiling is underway in many provinces.

The focus is now on strategic sourcing, bonded warehousing, and enhanced collaboration with customs consultants to maintain compliance and availability.

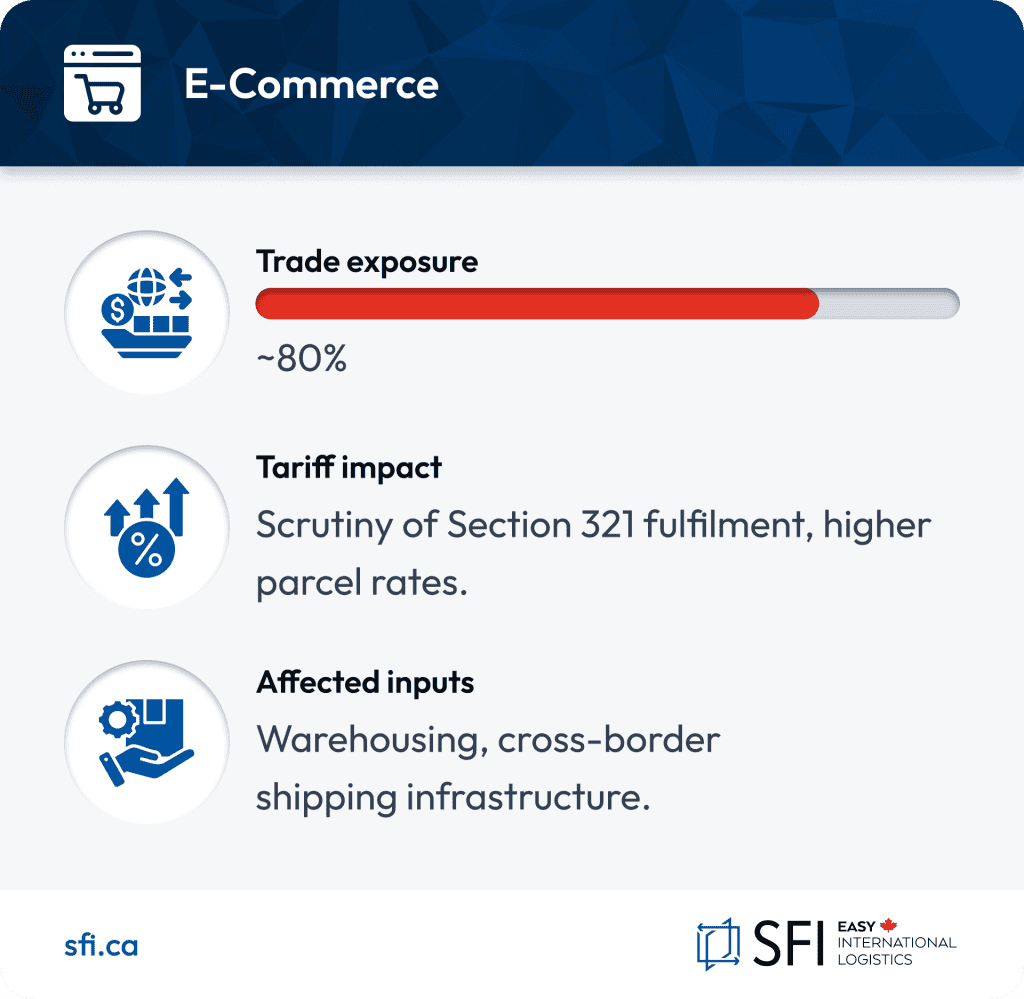

7. E-Commerce

- Trade exposure: ~80%

- Tariff impact: Scrutiny of Section 321 fulfilment, higher parcel rates.

- Affected inputs: Warehousing, cross-border shipping infrastructure.

For online retailers, 2025 has been a year of recalibration. Increased scrutiny of Section 321, which allows duty-free shipments under USD $800, has led to compliance headaches and margin squeezes. As reported by CBC, Canadian consumers are seeing delays and higher fees on U.S. parcels.

Chinese imports entering the U.S. under Section 321 De Minimis no longer qualify, which has thrown many non-U.S. eCommerce shippers into disarray. Canadian-based sellers are now rerouting inventory to U.S. warehouses to avoid punishing tariffs and remain competitive. In response, brands are also shifting toward bonded warehousing and hybrid logistics models near the border.

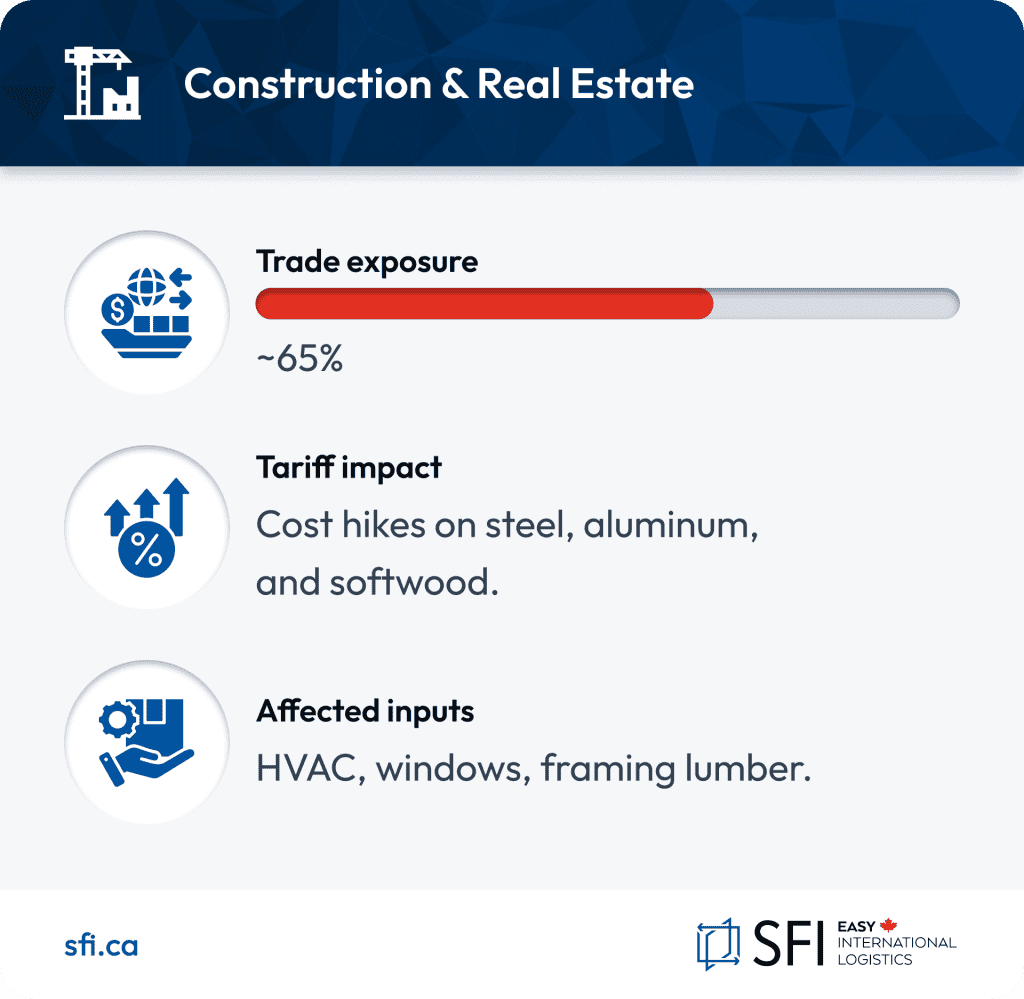

8. Construction & Real Estate

- Trade exposure: ~65%

- Tariff impact: Cost hikes on steel, aluminum, and softwood.

- Affected inputs: HVAC, windows, framing lumber.

Tariffs on construction materials are pushing projects over budget and delaying builds by weeks or months. For infrastructure funded by government grants, these overruns create political tension and execution risk.

According to Deeded.ca, these tariffs are exacerbating Canada’s housing affordability crisis, especially in urban centres where demand continues to outpace supply.

Developers are turning to local substitutions and phased procurement to manage cash flow and supply volatility.

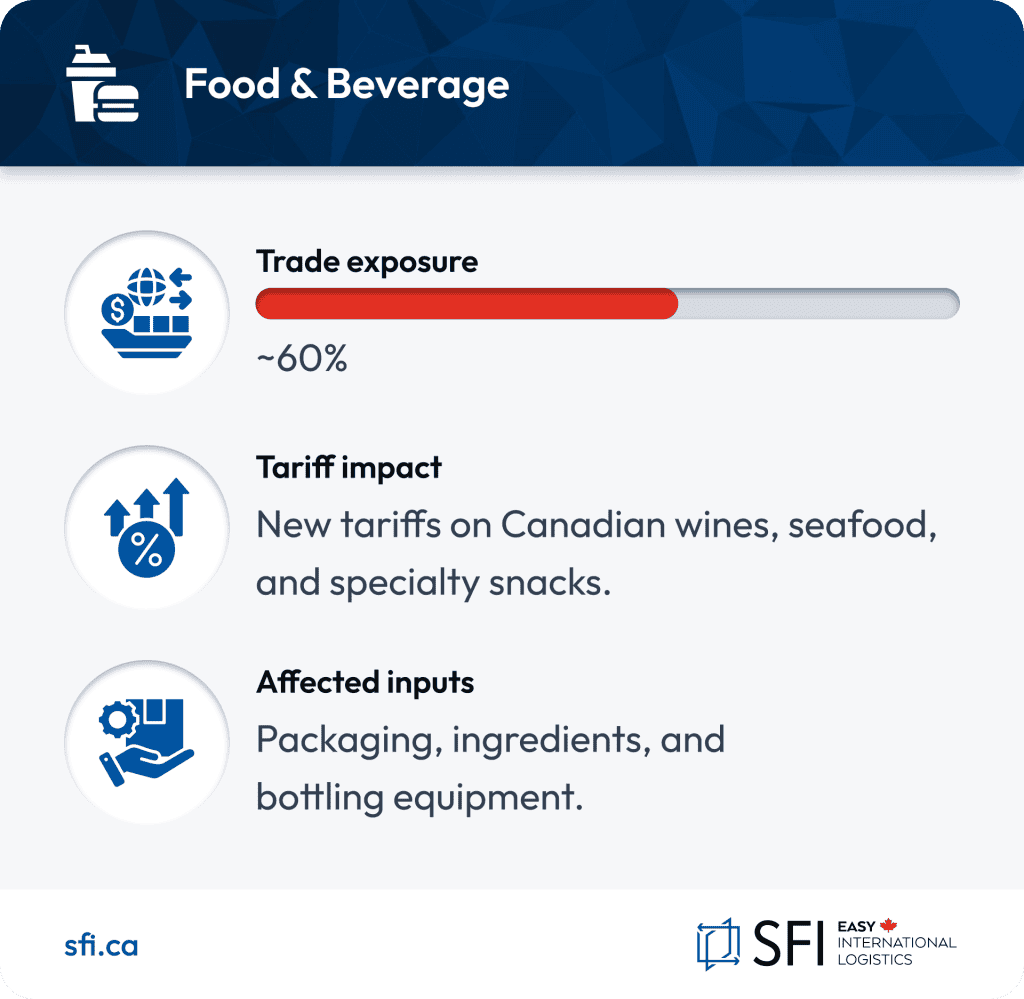

9. Food & Beverage

- Trade exposure: ~60%

- Tariff impact: New tariffs on Canadian wines, seafood, and specialty snacks.

- Affected inputs: Packaging, ingredients, and bottling equipment.

Canada’s wineries and craft distilleries are among the most directly impacted by the latest U.S. tariff packages. Shipments to the U.S. are being cancelled or rerouted, with Global News reporting growing concern among B.C. producers.

Other affected segments include seafood exporters, maple syrup producers, and boutique snack makers, many of whom lack the infrastructure to switch export markets easily.

Producers are being urged to lean into regional branding and consider expanding into Asian or European markets to stabilize their revenues.

What Can Businesses Do to Adapt?

As the trade landscape evolves, businesses must move from reaction to resilience planning. Key strategies include:

- Supplier diversification into Mexico, the EU, and Asia.

- Optimizing Section 321 fulfilment with experienced providers like SFI for non-Chinese based goods.

- Leveraging Canadian duty drawback programs.

- Applying for federal assistance, including tariff relief and financing.

- Engaging with trade associations and Customs Brokers like Strader Ferris International for real-time advocacy and updates.

- Using Canada as a temporary inventory hub for U.S.-bound goods until tariff conditions improve

The Road Ahead: Policy Volatility as a New Norm?

Looking forward, the CUSMA review period is shaping up to be a pivotal moment. Both Canada and the US will have the chance to renegotiate trade terms, but much depends on any looming decisions and actions of the U.S. government and overall global trade dynamics.

In the meantime, businesses should focus on flexibility and execution, not just to survive the current wave of uncertainty, but to build sustainable, cross-border trade strategies for whatever comes next.